For Workers – Orthotics are insurance-covered or tax-deductible, depending on your plan and location. You may discover that most health insurance plans cover orthotics if your doctor diagnoses you as having them for work purposes. For tax deductions, some countries and regions consider orthotics a medical expense if you pay out of pocket and have a prescription. What is covered and the tax benefits usually hinge on your employment, your health plan specifics, and any regionally specific regulations. To assist you in figuring out what counts, the main body explains typical insurance terms, tax regulations, and advice for employees. You receive concise action steps to independently explore your options and save money.

Key Takeaways

- You should get a copy of your insurance policy and read through it carefully to find out what documentation is needed for orthotics coverage and what exclusions or pre-authorization steps exist.

- Ensure that your medical diagnosis is well substantiated by a reputable healthcare specialist and gather any documentation, such as prescriptions and doctors’ letters, that you can.

- While custom orthotics have their benefits, not every person needs them over prefabricated orthotics. Chat with your doctor about what’s best for you.

- If your insurance does say no, read up on the reasons, collect all outstanding paperwork, and participate in the appeal process or an external review.

- See if your orthotic expenses are medical deductions at tax time. Keep good records and receipts.

- Seek out other assistance from your employer via wellness programs, spending accounts, or direct reimbursement. Be aware of workers’ comp and public insurance orthotics.

The Insurance Maze for Orthotics

Navigating the insurance labyrinth for orthotics can be challenging. Policies vary by country, insurance provider, and patient demographic, such as commercial, government, or uninsured. Certain areas cover only Medicaid orthotics for eligible patients, while others have more or less stringent guidelines. Most insurers classify orthotic devices as durable medical equipment (DME), which often requires a prescription from a physician and a fitting by a trained provider. Given the evolving landscape of insurance coverage, particularly for custom orthotics insurance plans, staying informed is crucial to avoid potential denials.

1. Medical Necessity

You have to demonstrate a definite medical diagnosis to warrant orthotics. This begins with your doctor diagnosing a particular foot or gait issue, say plantar fasciitis or flat feet.

Gather documentation from your doctor explaining the need for orthotics, including how symptoms impact your activities. For chronic conditions, they will often check if you have tried other therapies, like physical therapy, before escalating to orthotics. It helps to log your symptoms, treatments, and how your condition has progressed. The more detailed your documentation is, the stronger your claim will be.

2. Required Documentation

Obtain a prescription, medical records, and history of your treatment from your provider. Be sure these form letters discuss why you require orthotics, not just that you desire them.

Every insurance plan wants something different, so check their list to make sure you have it.

3. Custom vs. Prefabricated

Custom orthotics are constructed specifically for your foot, whereas prefabbed ones are off the shelf. Custom fits can provide better support and last longer for recurring aches. Certain plans will only reimburse for generic styles.

Discuss with your doc what fits your needs and pocketbook. Spending more now on custom orthotics means spending less later if you have chronic problems.

4. Plan Exclusions

Insurance is another maze. Some plans don’t cover a certain type of orthotics, or only cover a limited number of pairs a year. Some only cover them for certain diagnoses, and some don’t cover them whatsoever unless they’re included in a surgical plan.

Always look over your policy and ask your insurer about ambiguous terms so you’re not taken by surprise.

5. Pre-Authorization

Most plans require pre-authorization before paying for orthotics. You’ll have to submit all your records and the script.

Check in with your insurer to make sure they received your paperwork and if they have questions. If they deny your claim, determine why and fill in the missing information.

Proving Work-Related Necessity

If you’re looking for insurance coverage to pay for your orthotic devices or want to write them off as a tax deduction, you must demonstrate that your occupation is directly causing your foot conditions. You need to provide evidence linking your regular work to your medical need for orthotic insoles. Most insurers will pay for only one pair per year unless you can prove a work-related need. It can take a long time and a few visits to your healthcare provider until you have all the paperwork you need.

Your Occupation

Begin with the physical demands of your job. If you work in a profession that has you on your feet—healthcare, hospitality, or manufacturing—explain how many hours you’re standing or walking each day. Tell how activities such as lifting, bending, or walking on hard surfaces can stress your feet and aggravate conditions like plantar fasciitis or flat feet.

Next, consider how standing or walking long hours exacerbates the situation. Long shifts can start to hurt even if you came in with a minor ache. If you need to scale stairs, lug heavy loads, or wear stiff shoes, jot that down as well.

Discuss your profession’s impact on your feet with a care provider. Ask them to examine your schedule and suggest how your work may be aggravating your condition.

For example, you may be able to prove work-related necessity using published studies or workplace injury reports. A 2022 study demonstrated that orthotics cut healthcare costs by 30% for foot and ankle issues. Data like this can prove that your case is more compelling.

The Diagnosis

Obtain a formal diagnosis from a licensed medical professional. Your insurer will typically want to see a script and notes about your condition. Confirm that your diagnosis aligns with the insurer’s own criteria for medical necessity, such as flat feet or plantar fasciitis.

Save copies of any tests, such as X-rays, gait analyses, and physical exams, that prove you require orthotics. Your documentation should connect your work responsibilities to your podiatric issues.

Bring these records when chatting with your boss, your insurer, or your tax adviser. They are the foundation for your argument.

Doctor’s Letter

Have your doctor provide you with a note outlining your diagnosis and justification for orthotics. This letter needs to state your occupation, describe your symptoms, and explain how custom orthotics would help you remain on the job and prevent additional damage.

Make sure your doctor’s letter demonstrates why off-the-shelf won’t work. It needs to enumerate the anticipated health advantages, such as reduced pain or reduced absenteeism.

Leverage this letter as key documentation in your insurance claim. If your insurer has particular forms or regulations, coordinate with your doctor to revise the letter if necessary.

When Insurance Says No

Orthotics and insurance denials. They most frequently occur when your claim doesn’t neatly fit hard and fast rules. When insurance says no, new costs and choices arise. Here are some main reasons insurers deny coverage for orthotics:

- You’ve already hit your yearly limit, typically one pair a year.

- They want you to try store-bought insoles first.

- They say your foot pain isn’t a medical need.

- You didn’t get prior authorization.

- Your plan doesn’t cover custom orthotics.

- The claim lacks enough medical detail.

If your claim gets denied, look at your policy. Find out what is and isn’t covered. Other times, it’s a basic miscommunication or a forgotten form. Be aware that you can be stuck paying out-of-pocket if your claim remains denied or expenses exceed your plan’s caps. Custom orthotics can be costly, and partial coverage is typical. When insurance says no, you can appeal, provide more paperwork, or seek external assistance.

Understand Why

- Review the denial letter for reasons and next steps.

- Compare your doctor’s notes with the insurer’s requirements.

- Request a written explanation if the denial is unclear.

If your diagnosis or treatment history is fuzzy, fix it. Your foot pain or the necessity of orthotic devices is often misunderstood and can lead to denials. Talk to your insurer to understand their perspective. Clean any mistakes or omissions from your records. Providing additional paperwork, such as doctor’s notes or test results, will assist your claim for necessary orthotics.

The Appeal Process

Begin by reviewing your plan’s appeal steps, particularly regarding insurance coverage for necessary orthotics. Most insurers explain what to send and where. Compose a letter of appeal that provides new information and addresses the reason for denial, including medical records, your doctor’s letter, and evidence that over-the-counter supports did not work. Mail your appeal within the deadline; late appeals cannot be reviewed. Once you’ve filed, check in with your insurer frequently to ensure a smooth reimbursement process.

External Review

If your appeal doesn’t work, you can request an external review. This allows an independent professional to determine whether you deserve coverage for necessary orthotics. Check your country’s external review rules, as procedures vary. You will have to collect all your records, test results, and doctor’s notes for the reader. Have the patience to get your case straight. Take this review as your last chance to convince them you need orthotic devices.

Tax Deductions as a Fallback

If your insurance plan doesn’t cover orthotic devices, tax deductions can at least soften the blow of out-of-pocket expenses. The tax laws allow you to write off certain qualified expenses, including prefabricated orthotics, to decrease your taxable income. This is how you deduct these expenses and what records you need.

Medical Expense

- At least it counts as a medical expense if ordered by a doctor.

- Custom orthotics, including trimmings or re-bendings.

- Doctor’s fees related to your orthotic assessment or prescription

- Costs for materials and manufacturing of the orthotic device

- Transportation expenses to and from appointments for orthotic fittings

- Any repair or replacement charges for your orthotic devices

When you total your medical expenses, include all incidental expenses, such as fittings, adjustments, and even travel related to your orthotic devices. Keep every receipt and jot down the date, provider, and purpose. The IRS sets limits: only expenses that exceed 7.5% of your adjusted gross income are deductible. If you need long-term care with prefabricated orthotics, these expenses might qualify as well, so check your plan for eligible services.

Itemized Deductions

If you itemize on your tax return and your total medical expenses, including orthotics, exceed the standard deduction, then you’re in luck. Compare your itemized total with your country’s standard deduction, say $4,710 if you are 61 to 70. If your itemized total is greater, then claiming it can reduce your taxes.

Orthotic costs are included with other medical expenses on Schedule A of Form 1040 or 1040-SR. Taxpayers under 65 or unmarried may have other rules, so see the latest IRS guidance or your local tax authority. Free resources such as TCE (Tax Counseling for the Elderly) are invaluable, especially if you’re over 60, to ensure you select the correct method.

Record Keeping

Save receipts, invoices, and doctors’ notes into a folder or digital file. Just have each document present the date, provider, and cost. Update your records if your needs or expenses shift throughout the year. Review your records at year-end to catch any missed deductions.

Well-documented records prove your assertions and assist in responding to tax authorities’ inquiries. Careful tracking means you won’t leave qualifying expenses on the table.

Employer’s Role in Foot Health

Employers influence your foot health by establishing workplace policies and selecting benefits that impact how you address foot health, including coverage for necessary orthotics. At some companies, it’s a real part of wellness. At others, the devil’s in the details, and it’s up to you. What your employer decides about wellness programs and reimbursement processes ultimately molds your options and costs.

Wellness Programs

Your employer can do wonders for your feet by offering programs that include orthotic devices and foot health education. When employers supplement these initiatives with advice on selecting shoes, caring for your feet, and detecting early signs of issues, it greatly benefits employees. Some companies conduct screenings that test for flat feet, bunions, or signs of early nerve damage. Additionally, there may be seminars or web content on managing foot pain or how to safely stand on hard floors. Big companies will occasionally partner with providers for workshops on selecting shoes, orthotic insoles, or stretching to relieve tension, demonstrating their commitment to employee health.

Spending Accounts

Flexible spending accounts and health savings accounts assist you in covering orthotic devices and associated care with pre-tax dollars. Some job-based healthcare plans consider orthotics to be durable medical equipment, allowing you to purchase prefabricated orthotics using spending accounts. By earmarking some of your salary for orthotics or visits, you can effectively reduce your tax burden. If you anticipate requiring custom orthotics, strategize your FSA or HSA contributions early in the year. Be sure to check with HR about guidelines, as some programs may need a doctor’s slip or require specialized fitting, making spending accounts a clever way to manage out-of-pocket expenses.

Direct Reimbursement

A few employers provide direct reimbursement for orthotic device costs, allowing you to claim back what you spend on necessary orthotics. Such programs are most effective if your employer communicates the policies clearly and simplifies the claims process. Direct reimbursement provides you with flexibility, particularly if you require a custom orthotic device or if your health insurance plan imposes restrictions. For employers, these programs can assist in recruiting and retaining quality employees and reduce long-term healthcare expenses by avoiding larger issues down the road. Know what paperwork you need and how much your employer will cover, as coverage can vary greatly between companies and sometimes even between plans within a company.

Navigating Different Insurance Systems

Orthotic coverage isn’t universal, especially when considering necessary orthotics like custom orthotics or prefabricated orthotics. What you receive varies by insurance plan, work type, and living location. Each system, be it private, public, or workers’ comp, has its own regulations, boundaries, and procedures.

Private Plans

Feature | Description |

Coverage Scope | Often covers custom orthotics, but may limit to one per foot, per year |

Annual Limits | Most plans set a yearly cap on orthotic benefits |

Pre-authorization | Commonly needed before getting devices; ask your provider |

Out-of-pocket Costs | Deductibles and copays can add up, especially with higher-tier plans |

Documentation | Doctor’s notes and proof of medical need are usually required |

A few private plans distinguish themselves by simplifying access. They provide higher annual limits and more flexible policies on how many pairs you can receive annually. Seek out plans that bypass pre-authorization or paperwork hassles. These things save you time and stress.

Private insurance premiums can differ significantly. Certain low-premium plans will charge you more out-of-pocket. Higher-premium plans pay more for orthotics. Know your deductible and what counts against it. If you require more than one pair or custom orthotics, you can compare your options side by side.

For reasonable coverage, solicit opinions or look up reviews for insurance companies that approve orthotics. There are some globally reputed providers such as Allianz, Bupa, and Cigna. Check each provider’s current orthotics policy before you subscribe.

Public Programs

Medicaid and Medicare each have their own rules for orthotics. Medicaid coverage is limited to qualified individuals, and certain states, such as New Mexico, provide it, whereas others do not. Depending on your insurance, Medicare will cover orthotics if they are medically necessary, but custom devices are typically not included.

Access is limited. You require income, disability, or age verification. Each program determines its own coverage limits, annual caps, and occasionally desires multi-approvals.

The application process is paperwork-intensive. Gather doctors’ prescriptions, complete forms, and send them with any evidence of need. Certain other areas will be quicker. Everything tends to lag.

Public insurance policies shift. Pay attention to policy changes every year. New limits or coverage changes, or new paperwork requirements, can impact your access to orthotics.

Workers’ Compensation

Work comp policies will often pay for orthotics if your injury is work-related. Such coverage is typically the injury claim, not your primary health insurance.

You’ll have to submit a claim for orthotic coverage. Provide medical evidence from your physician that the orthotic is necessary for your injury. Hold onto everything, including doctor’s notes, injury reports, and receipts.

Documentation gets your claim through. Keep all your paperwork and jot down the dates of your injury and treatment. If you encounter denials, you can appeal with this documentation.

Occasionally, you have to advocate to receive. If coverage is denied or delayed, seek advice from your employer, doctor, or a workers’ advocacy group. Personal advocacy is frequently the important thing to getting orthotics lined promptly.

Conclusion

You have a lot of questions about orthotics and the costs that come with them. Some insurance plans cover a portion of the bill, but regulations vary from jurisdiction to jurisdiction. You might have to demonstrate that your foot pain ties to your work. If your plan says no, you can turn to tax breaks. Certain workers receive assistance from their employer or union, so it’s worth perusing your contract. Every step, consulting your physician, saving your receipts, and even asking your employer, counts. To maximize your claim, be assertive, inquire, take good notes, and make sure to fight for your needs. Want to save cash and stay standing? Check your benefits or chat with your HR team today.

Frequently Asked Questions

Are orthotics covered by insurance for workers?

It depends on your insurance plan and country. Many plans cover orthotic devices if your doctor prescribes them for a medical reason. Always check your policy details and request clarification from your insurer regarding eligible expenses.

What proof do I need to show that orthotics are work-related?

You typically need a physician’s prescription stating that orthotic devices are necessary for your work. Occasionally, a letter from your employer or a report from a healthcare provider can assist your claim.

What can I do if my insurance denies coverage for orthotics?

You can always appeal to your insurance plan regarding necessary orthotics. Collect corroborating medical papers and consult your healthcare provider for assistance. If your appeal doesn’t work, see if your country’s tax laws provide other support.

Are orthotics tax-deductible for workers?

So what are orthotic devices? Are prefabricated orthotics covered by insurance or tax-deductible for workers as well? ALWAYS save your receipts and prescriptions for reimbursement purposes! Check your country’s tax office or a tax professional for specific requirements.

Can my employer help with the cost of orthotics?

Some employers provide health benefits or wellness programs that might include coverage for orthotic devices, particularly if your profession involves extensive standing or walking. Consult your HR department for options related to insurance coverage.

How do insurance systems differ for orthotics coverage globally?

Insurance policies differ by country and provider, with some offering national health insurance that covers necessary orthotics, while others rely on private insurance. Always check with your local laws and insurance policies!

What should I do before buying orthotics?

First, get checked by your doctor regarding your foot conditions. Look into your insurance coverage and talk to your employer about benefits related to orthotic devices. Gather the necessary paperwork prior to purchasing so you have a good chance of getting reimbursement.

Stay Comfortable and Pain-Free With Custom Orthotics for Workers on Their Feet All Day From The Shoe Doctor

If foot, knee, or back pain is wearing you down at work, your footwear support may be part of the problem. Standing or walking all day puts constant stress on your feet and joints. Small alignment issues can accumulate quickly, leading to fatigue, soreness, and chronic pain by the end of every shift. Without proper support, each step adds strain that your body never really gets a break from.

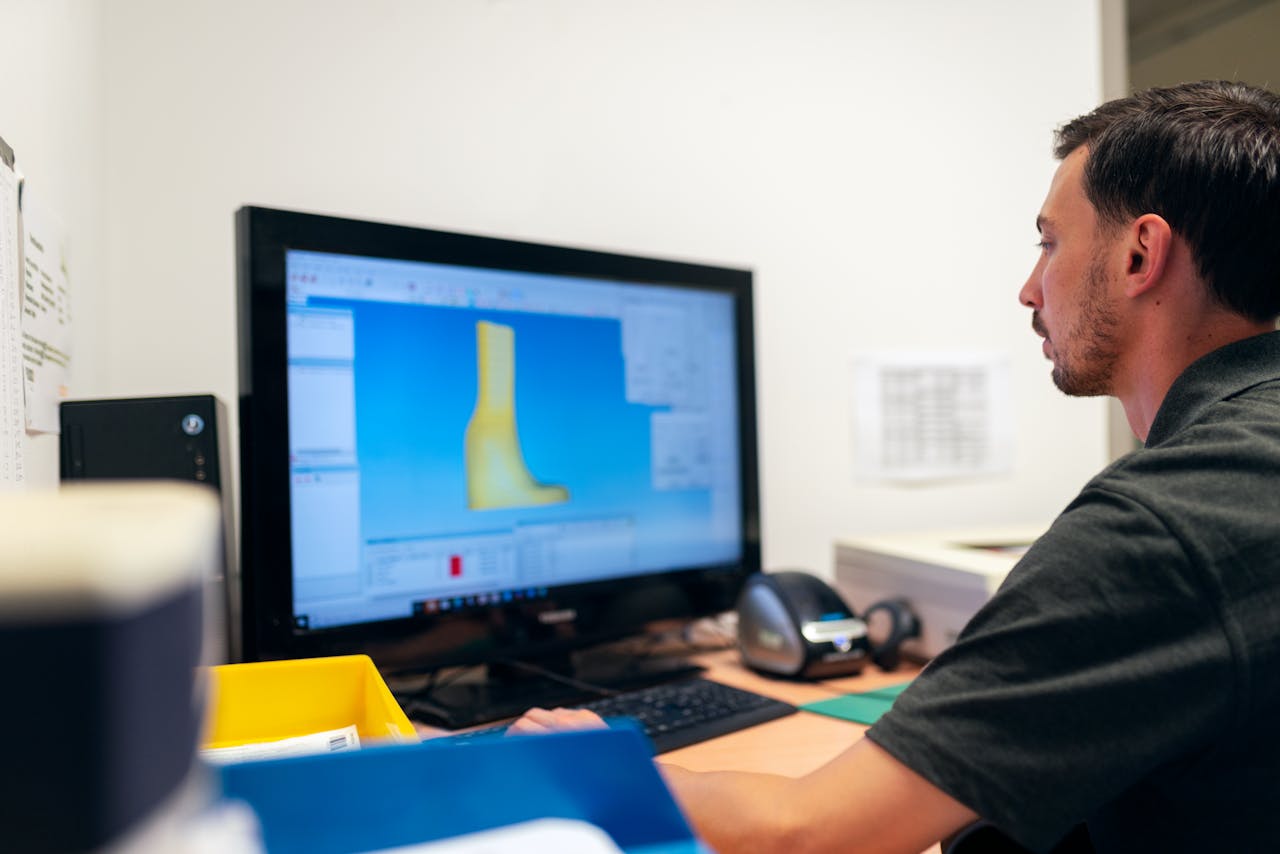

At The Shoe Doctor, we specialize in helping workers who spend long hours on their feet stay comfortable and supported. Using advanced 3D foot-mapping technology, we analyze how your feet stand, move, and bear weight throughout the day. That data enables us to design custom orthotics that enhance stability, correct alignment, and reduce pressure in high-stress areas, regardless of your industry, including healthcare, retail, hospitality, construction, or education.

With over 20 years of experience, Russell combines precise technology with hands-on craftsmanship to create orthotics that do more than cushion your feet. They help reduce fatigue, lower injury risk, and support your body through long shifts over time. Through our partnership with the Spine & Injury Medical Center in San Jose, we also look at posture and gait to support full-body balance and long-term relief.

If you work on your feet in the South Bay Area, schedule your free consultation today. Let The Shoe Doctor help you get through every shift with less pain and more energy.

Disclaimer

The materials available on this website are for informational and entertainment purposes only and are not intended to provide medical advice. You should contact your doctor for advice concerning any particular issue or problem. You should not act or refrain from acting based on any content included in this site without seeking medical or other professional advice. The information presented on this website may not reflect the most current medical developments. No action should be taken in reliance on the information contained on this website, and we disclaim all liability for actions taken or not taken based on any or all of the contents of this site to the fullest extent permitted by law.